|

||||||||||||||

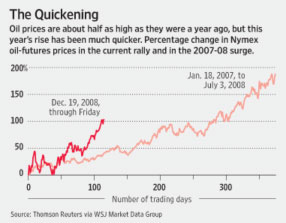

| Wall Street Journal : June 08, 2008 In Rising Crude Prices, Some See '08 Replay. Climb Has Been Faster Than Last Year's By BEN CASSELMAN Crude Oil The rapid rise in the price of crude-oil futures, which touched $70 on Friday, is sparking fears of a repeat of last year's energy rollercoaster. Crude oil futures on the New York Mercantile Exchange on Friday hit $70.32 before closing down 37 cents at $68.44. Prices remain well below what they were a year ago, when oil was selling for more than $125 a barrel, but the climb in recent months has been even steeper than last year's. Prices have more than doubled since closing at $33.98 on Feb. 12, the recent low. They're up more than 50% since the start of 2009, compared to a 33% rise during the same period last year. Traders in crude oil and natural gas options work on the floor of the New York Mercantile Exchange on June 3. Oil's climb has been steeper this year compared with 2008, though prices remain lower. Experts see two main forces behind the recent rise in prices that echo last year's climb. First, investors are putting money into oil as a hedge against inflation and a weakening dollar; last year, investors were guarding against a weakening stock market. Second, investors are betting that early signs of economic recovery suggest a looming shortage of oil. A year ago, oil bulls argued rising demand in China and India would lead demand to outstrip supply. "What we are seeing here is a replay...It's the same phenomenon," said Ann-Louise Hittle, head of oil market analysis for the consulting firm Wood Mackenzie. To be sure, there are significant differences between this year and last. A year ago, the global economy was cooling but not yet in recession, and demand for oil was still rising worldwide. OPEC, the Organization of Petroleum Exporting Countries, was producing at close to its maximum rate. Now demand is falling. The International Energy Agency predicts global oil consumption will be 3% lower in 2009 than in 2008. And OPEC members are producing millions of barrels a day below their capacity. Meanwhile, U.S. crude oil stockpiles are 19% higher than a year ago, according to the Energy Information Administration. That's enough to meet 25 days of U.S. demand, up from 20 days a year ago. Some analysts warn that with prices being driven by investor sentiment, not market fundamentals, the leap in prices could give way to an equally sharp drop -- just like last year.

"There may be enough momentum to carry us up to just $72.50, but then I think the correction is going to be just that dramatic," said Guy Gleichmann, president of United Strategic Investors Group, a commodities brokerage in Hollywood, Fla. The rise in energy costs could slow down recovery from the recession, some economists suggest. Retail gasoline prices have risen 23% since the end of April, to $2.52 per gallon on average. Tom Kloza, chief oil analyst for the Oil Price Information Service, warned that could lead more consumers to pull back spending. But there are signs that oil producers, many of which slashed spending when prices were falling, are gaining confidence in the price recovery. The Russian oil company TNK-BP this week said it would increase its capital spending by $400 million to $3.7 billion, Reuters reported. Exxon Mobil Corp., the biggest Western oil company, has in recent days announced investments in large, long-term projects, which analysts said will be viewed as a green-light for others to pick up the pace of their spending. That increase could boost supplies, easing pressure on prices as demand eventually recovers. Oil producers have warned for months that reduced drilling could lead to supply shortages when the recession ends. —Russell Gold contributed to this article. FUTURES AND OPTIONS TRADING INVOLVE RISK OF LOSS AND MAY NOT BE SUITABLE FOR EVERYONE. United Strategic Investors GroupGuy Gleichmann, President 2641 E. Atlantic Blvd. Suite 208 (800) 974 – 8744

|

1- 800-974-8744

|

Home | Contact | Client Services | FAQ | News | Quote board | Resources | Terms of Use | Privacy Policy | Site Map

" Futures and Options trading involve risk of loss and may not be suitable for everyone."

© 2004 United Strategic Investors Group, Inc. All rights reserved